What is Alladin Algo Trading Software – Get Started Now!

Alladin Algo Trading Software automates trading, utilising advanced algorithms for real-time analysis, risk management, and efficiency.

In modern finance, technology is revolutionising how trades are executed. Let’s dive into the details of this cutting-edge trading software.

Table of Contents

Understanding Algo Trading:

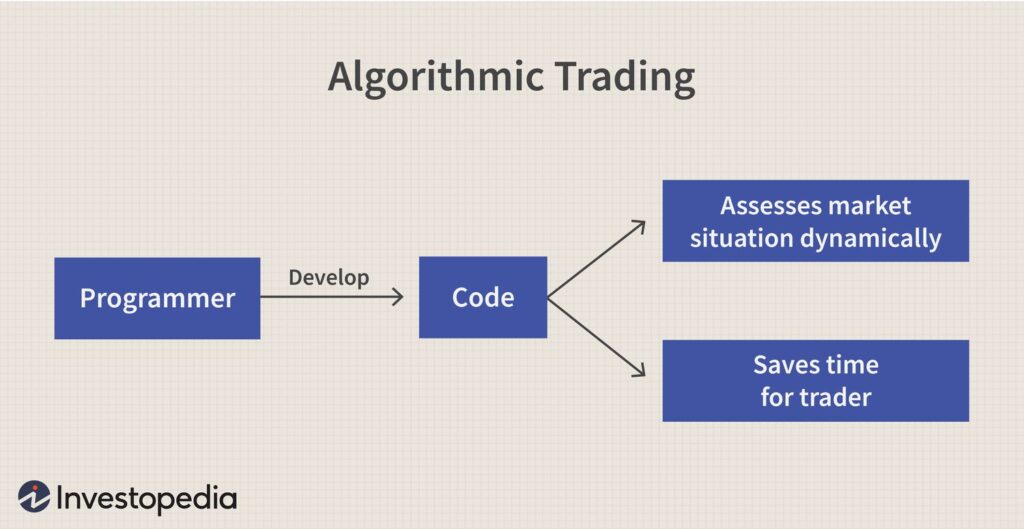

Before exploring Alladin Algo Trading Software, it’s important to understand the concept of algorithmic trading. In simple terms, algo trading refers to the use of automated software and algorithms to execute trades on behalf of traders.

These algorithms are designed to analyze market data and execute orders at optimal times, based on pre-set conditions. This approach helps remove human emotions, allowing for faster and more efficient trading.

Key Features of Alladin Algo Trading Software:

Advanced Market Analysis:

Alladin uses cutting-edge data analysis tools to monitor market trends and price movements in real time. This allows the software to identify patterns and opportunities that manual traders might miss.

Automation of Trades:

One of the biggest advantages of Alladin is its ability to automatically execute trades based on predefined rules. This reduces human error and ensures that trades are executed at the most favourable times.

Customization:

Alladin offers a high degree of customization. Traders can tailor their trading strategies by adjusting parameters like risk tolerance, asset preferences, and trading frequency.

Risk Management Tools:

Risk management is a critical aspect of trading, and Alladin provides features that help minimize risk. The software can set stop-loss limits, monitor drawdowns, and adjust positions automatically to protect capital.

Backtesting:

Alladin allows traders to backtest their strategies against historical data. This is a valuable tool for optimizing trading strategies before applying them to live markets.

Real-Time Monitoring:

With Alladin, traders can monitor the performance of their algorithms in real time. This ensures that any adjustments or fine-tuning can be made immediately if necessary.

Multi-Asset Trading:

Alladin supports trading across a variety of assets, including stocks, forex, commodities, and cryptocurrencies. This gives traders the flexibility to diversify their portfolios.

How to Get Started with Alladin Algo Trading Software:

If you’re eager to leverage the power of Alladin Algo Trading Software, getting started is straightforward. Here’s a step-by-step guide to help you set up and begin trading:

Sign Up and Create an Account:

The first step is to sign up for an account on the Alladin platform. Most platforms will require basic personal information and verification to ensure security and compliance.

Choose Your Preferred Trading Strategy:

Alladin offers a variety of pre-built trading strategies. You can start by choosing one that aligns with your goals. Alternatively, if you are experienced, you can create a custom strategy using the platform’s advanced features.

Set Your Parameters:

Customize your risk management settings, including stop-loss, take-profit levels, and trade size. You can also set the specific assets you wish to trade and the frequency of trades.

Backtest Your Strategy:

Once you’ve set up your parameters, you can backtest your strategy using historical market data. This helps you evaluate how your algorithm would have performed in past market conditions and fine-tune it for better results.

Deploy the Algorithm for Live Trading:

After backtesting, you can deploy your algorithm for real-time trading. Alladin will execute trades automatically based on your set parameters.

Monitor and Adjust:

Even though Alladin automates the process, it’s essential to monitor your trades regularly. You can make adjustments to your trading strategy as market conditions change, optimizing it for ongoing performance.

Read More: What Software Can Usescuf Envision Pro

Benefits of Using Alladin Algo Trading Software:

Increased Efficiency:

By automating the trading process, Alladin can execute trades much faster than human traders. This leads to greater efficiency in taking advantage of market opportunities.

Enhanced Accuracy:

Algorithms can process vast amounts of data quickly and accurately, reducing the risk of errors that might occur with manual trading. This enhances the overall accuracy of trade executions.

24/7 Trading:

Alladin operates around the clock, ensuring that trades are executed even when the trader is not actively monitoring the market. This is especially useful in global markets that are open 24/7.

Reduced Emotional Bias:

Emotional decision-making is a common pitfall in trading. Alladin’s algorithms follow a strict set of rules, ensuring that trades are executed without the influence of emotions like fear or greed.

Improved Profit Potential:

By taking advantage of market inefficiencies and executing trades at optimal times, Alladin can potentially increase the trader’s profitability.

Who Can Benefit From Alladin Algo Trading Software:

Professional Traders:

Experienced traders who want to optimize their strategies and execute trades faster can benefit greatly from using Alladin.

Retail Traders:

Even those without extensive trading experience can take advantage of Alladin’s user-friendly interface and automation features.

Institutional Investors:

Large-scale investors looking for advanced trading solutions can leverage Alladin’s high-level customization and risk management tools.

FAQ’s:

1. What is Alladin Algo Trading Software?

Alladin is an automated trading platform that uses algorithms to execute trades based on predefined rules.

2. Who can benefit from Alladin Algo Trading Software?

Professional traders, retail traders, and institutional investors can all benefit from using Alladin’s features.

3. How does Alladin Algo Trading Software automate trades?

It uses advanced algorithms to analyze market data and execute trades automatically according to set parameters.

4. Can I customize my trading strategy on Alladin?

Yes, Alladin allows users to customize risk management, asset preferences, and trading frequency.

5. Does Alladin support 24/7 trading?

Yes, Alladin operates around the clock, ensuring trades are executed even when markets are continuously open.

Conclusion

Alladin Algo Trading Software is a powerful tool that can revolutionize the way traders approach the markets. With its advanced algorithms, real-time monitoring, and customizable features, it provides traders with the tools to make smarter, faster, and more accurate decisions. Whether you’re a professional trader or just starting, Alladin can help automate your trading and improve your overall performance in the financial markets.