Why Is It Useful To Have Your Bank Account And Routing Numbers When Using Tax Preparation Software?

Bank account and routing numbers streamline tax filing with faster refunds, secure payments, and reduced errors.

Below, we’ll dive deeper into why these numbers are essential and how they can enhance your tax preparation experience.

Table of Contents

What Are Bank Account and Routing Numbers:

Before exploring their importance, let’s understand what these numbers represent:

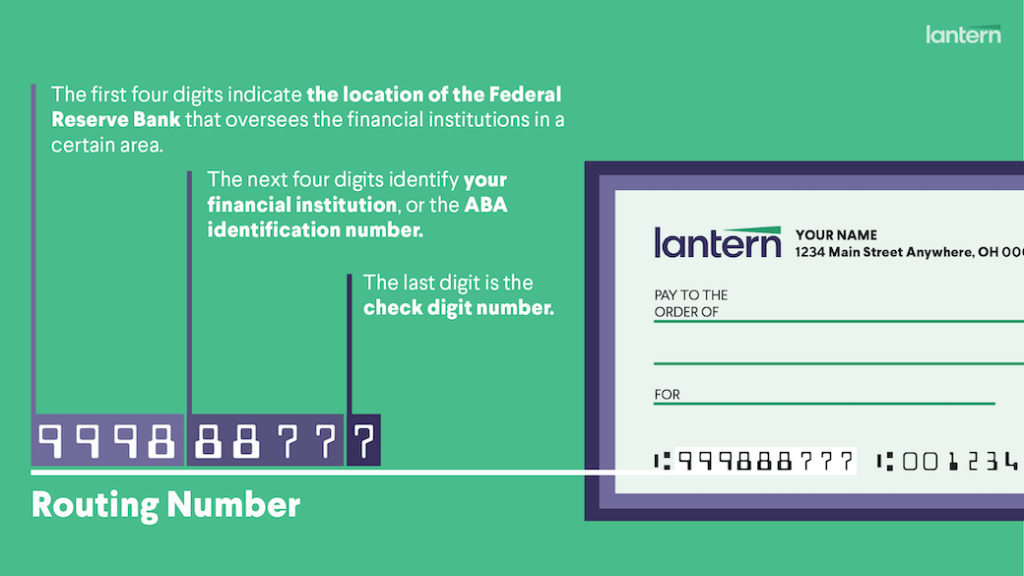

- Bank Account Number: This unique number identifies your specific account at your financial institution.

- Routing Number: This nine-digit code identifies the bank or credit union where your account is held.

These numbers are critical for processing electronic transactions, including those related to tax refunds and payments.

Speed Up Your Tax Refund with Direct Deposit:

One of the primary reasons tax preparation software asks for your bank details is to enable direct deposit for refunds. If you’re entitled to a refund, this method ensures you receive it in the quickest way possible.

- No Waiting for Checks: Paper checks can take weeks to arrive by mail and are prone to getting lost or stolen. Direct deposit transfers your refund directly to your bank account, often within 21 days.

- Convenient Access to Funds: With your refund deposited electronically, you can access your money immediately, avoiding the hassle of depositing a check at the bank.

- Eco-Friendly Option: Using direct deposit reduces paper waste and promotes a more sustainable way to handle refunds.

Imagine the relief of seeing your tax refund in your account just days after filing—especially if you’re counting on that money for urgent expenses or savings goals.

Make Tax Payments Effortless and Secure:

Not everyone receives a refund. If you owe taxes, having your bank account and routing numbers makes it easy to pay directly from your account. Tax preparation software integrates this feature seamlessly.

- Avoid Penalties: Paying your taxes on time helps you avoid late fees and penalties from the IRS.

- One-Step Payment: Skip the tedious task of writing and mailing a check. Instead, initiate an electronic payment directly through the software, ensuring it’s processed instantly.

- Safe and Reliable: Electronic payments are encrypted and secure, reducing the risk of errors or fraud compared to mailing sensitive information.

For those who prefer to schedule payments, some tax software even allows you to set up payments in advance, giving you one less thing to worry about as the filing deadline approaches.

Minimize Errors and Avoid Delays:

Entering your bank account and routing numbers into tax preparation software ensures greater accuracy than manually writing them on paper forms. The software validates your entries in real time, helping you avoid costly errors.

- Error Prevention: Mistakes in account or routing numbers can result in delayed refunds or payments being sent to the wrong account.

- Automatic Checks: Tax software often flags incomplete or incorrect information, ensuring your filing is accurate and compliant.

- Peace of Mind: Knowing your details are correct lets you focus on other aspects of your tax return without worrying about financial mishaps.

Split Refunds for Smarter Money Management:

Did you know you can direct your tax refund to multiple accounts? With your bank account and routing numbers ready, tax software allows you to split your refund among savings, checking, or even retirement accounts.

- Encourage Savings: Automatically deposit part of your refund into a high-yield savings account to grow your financial cushion.

- Invest in Your Future: Allocate a portion of your refund to an IRA or other investment accounts.

- Budget-Friendly Option: Use some of your refund for immediate expenses while saving or investing the rest.

This feature is a simple yet effective way to manage your finances and meet your financial goals without additional steps.

Simplifies Future Tax Filings:

Once you’ve entered your bank account and routing numbers into tax preparation software, they’re typically saved securely for future use. This means next year’s tax filing will be even more streamlined.

- Saves Time: No need to re-enter your bank details each year.

- Increased Accuracy: Using the same verified information year after year reduces the likelihood of errors.

- Consistency for Financial Planning: With everything in one place, you can better plan for refunds, payments, and financial goals.

Supports Flexible Payment Arrangements:

If you owe taxes but can’t pay the full amount at once, your bank account and routing numbers are critical for setting up an IRS payment plan. Many tax software platforms let you arrange installment payments directly from your bank account.

- Manageable Payments: Spread your tax bill over several months instead of paying a lump sum.

- Avoid Default: Ensure timely payments to stay in compliance with the IRS.

This feature is particularly useful for individuals with complex tax situations or unexpected liabilities.

Enhances Overall Convenience:

In today’s digital age, convenience is king. By having your banking information at your fingertips, you can:

- Complete Your Taxes in One Sitting: No need to pause and search for financial details.

- Stay Organized: Keep all tax-related transactions in one place for easier record-keeping.

- Reduce Stress: Simplify the process and gain confidence in your tax filing.

How to Protect Your Bank Details While Filing Taxes:

While providing your bank account and routing numbers is necessary for seamless tax filing, safeguarding this information is just as important. Here’s how to do it:

- Use Trusted Tax Software: Choose platforms with strong encryption and a reputation for security, such as TurboTax, H&R Block, or IRS Free File.

- Avoid Public Wi-Fi: File your taxes on a secure, private internet connection to prevent unauthorized access.

- Monitor Your Accounts: Regularly check your bank account for any unusual transactions after filing.

- Enable Two-Factor Authentication: Use this feature on your tax software and bank account for added protection.

FAQ’s:

1. Why are bank account and routing numbers needed for tax preparation?

These numbers are essential for direct deposit refunds, electronic tax payments, and ensuring accurate transactions during tax filing.

2. How does having these details speed up tax refunds?

Direct deposit ensures refunds are transferred electronically to your account, usually within 21 days, avoiding delays associated with paper checks.

3. Can I split my tax refund across multiple accounts?

Yes, tax software allows you to allocate refunds to different accounts, such as savings, checking, or investment accounts, for better financial management.

4. Is it safe to provide bank details in tax software?

Yes, reputable tax software uses encryption and security measures to protect your information. Avoid public Wi-Fi and use two-factor authentication for added safety.

5. What happens if I enter incorrect bank details?

Mistakes in account or routing numbers can delay refunds or misdirect payments. Tax software helps minimize errors by validating entries in real-time.

Conclusion:

Having your bank account and routing numbers when using tax preparation software is not just helpful—it’s transformative. These details allow you to receive refunds faster, pay taxes securely, avoid errors, and even improve your financial planning.By preparing ahead and choosing reliable tax software, you can turn tax season into a stress-free experience. So, gather your financial details, start filing, and take control of your tax journey today.

Related Articles:

- Read More: Is the MacBook Touch Screen a Software Issue or Hardware

- Read More: Is Glarysoft Software Update Pro 6 Good

- Read More: Software Updates Error Id 3104046